Understanding Wework’s Valuation

WeWork was founded in New York in 2010 with a goal to offer co-working spaces to entrepreneurs, startup companies, freelancers and even larger enterprises. WeWork has grown rapidly ever since its establishment, making it one of the largest and most visible co-working chains in the world.

Since 2019, I have been an independent member of WeWork based in Paris, using the co-working space for personal projects. For over a year, I have been able to witness the big changes as the company has evolved : new offices being built, new furniture, more space, but not so many members.

The question of fair value for WeWork has been a real issue for investors, as many of them have failed to price the business. WeWork spiralled from a $47 billion valuation to talk of bankruptcy in just 6 weeks. Let’s take a look at the business step by step.

Key People

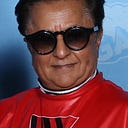

Adam Neumann co-founded WeWork, alongside Miguel McKelvey, and served as CEO of WeWork from 2010 until 2019. Neumann went under loads of pressure from investors during WeWork’s IPO filing, forcing him to resign in September 2019. Prior to WeWork, Neumann and McKelvey created Green Desk in 2008, a shared-workspace business focusing on sustainability, which served as the precursor to WeWork.

Miguel McKelvey is co-founder, with Adam Neumann, of WeWork. McKelvey serves as Chief Culture Officer. He directs construction, architecture, and web design for the company, and is also responsible for building and operating culture. Before WeWork, McKelvey worked at Jordan Parnass Digital Architecture in Manhattan. Adam Neumann worked in the same office building, and the two met at a party. They co-founded WeWork in 2010.

Sandeep Mathrani took Neumann’s place as CEO of WeWork in September 2019. Mathrani is a former real estate executive who has been called a ‘corporate turnaround artist’. He was previously an executive at Brookfield properties, and has a history of turning around businesses dealing with debt.

Marcelo Claure is currently the chief executive officer of SoftBank Group International. Claure previously served as Sprint’s CEO from 2014 until 2018. He was appointed the executive chairman of WeWork in October 2019.

Business Model

WeWork’s business model is quite simple to understand. They generally sign long term leases and spend a lot of upfront capital to build-out and furnish the space as they see fit, and then sublease the space to smaller tenants at a premium.

“WeWork takes out a cut-rate lease on a floor or two of an office building, chops it up into smaller parcels and then charges monthly memberships to startups and small companies that want to work cheek-by-jowl with each other.” — Adam Neumann, Former CEO of WeWork

WeWork offers several plans to workers and business with varying prices. For example, a worker can get a “Hot Desk” for $400 per month, which will give them guaranteed workspace in a common location. For a desk of your own in the same spot each day, the fee is $600 per month. Standard private office space starts at $900 per month.

The prices WeWork pays for offices vary a lot depending on the location. Offices in New York cost more per meter squared than offices in Barcelona. However, prices for clients are approximately fixed at the similar prices worldwide, making it more profitable for WeWork in cheaper real-estate areas.

Target market

When WeWork first opened for business in 2010, its members were largely freelancers, small businesses, and startups. Now the company says 40% of its members work for companies with 500 or more full-time employees, up from 30% a year ago, and that enterprise members are its fastest-growing type of membership.

WeWork has also targeted large companies such as IBM, Facebook, Microsoft, and UBS.

Total Addressable Market (TAM)

There are approximately over 24,000 flexible workspaces in the entire world, which represents 521 million square feet of flexible space. 14% of employees at large companies use co-working spaces. Co-working spaces accounted for almost 10% of space leased in Manhattan in the first half of 2018. (Source Colliers International)

Market structure and dynamics

Co-working spaces are becoming more and more popular for SMBs and Start-ups. Until 2022, the number of co-working spaces is expected to grow at an annual rate of 6% in the U.S. and 13% elsewhere.

Competition : List of incumbents

- IWG (Regus, HQ et Spaces) — $3.2B in revenue — 3300 locations.

- CBRE — World’s largest commercial real-estate services firm — 4% of CBRE’s leasing revenue, growing to 10% in the coming years.

- Industrious — Total funding $222M Series D — $71M in revenue.

- Knotel — $200M in revenue — Total funding $650M — Valuation $1.6B

Strengths vs. competitors

- Networking, events and activities- WeWork focuses a lot on events and strives to build an organic community of ‘WeWorkers’ who network both inside and outside WeWork offices.

- Great locations

- Discounts and offers : Slack, AWS, and other brands like Equinox, Dell, Ticketmaster.

Weaknesses vs. competitors

- More expensive : Prices vary between spaces and cities, however generally WeWork is more expensive than most other co-working spaces.

Long-term competitive advantage

WeWork has many strategies to create an economic moat around the company. For instance :

- Acquiring regional players to keep competition away (Naked Hub, SpaceMob).

- Acquiring companies in the architectural space (Case Inc, Field Lens) using expertise and technology to optimise its space.

- Global offerings

- Collecting data and optimising working spaces using technology (Commercial real estate data is notoriously limited and often of poor quality).

However, WeWork’s competition has risen over the years and their business model has been replicated by its competitors. Other co-working companies with scale are also able to offer global locations for their members, and collect data the same way as WeWork.

The remaining competitive advantages are their strategic acquisitions. The number of acquisitions have been ranging between 5–7/year since 2017. As mentioned previously WeWork’s losses, solvability and funding have been a great issue since their failed IPO, many analysts believe the number of acquisitions will decrease over the coming years. As a result, they may lose their final competitive advantage.

Funding/ Deal

- Round size : Before the acquisition by Softbank, WeWork’s last funding round was a Series G $5B Funding at a $48.68B valuation in January 2019. Softbank is WeWork’s biggest backer.

- Runway : In July 2019, WeWork had just under $2B in available cash. The company’s burn rate is roughly $100M/month.

Initial Public Offering

After being valued at $47B by Softbank during January’s $2B funding round, WeWork released its S-1 filing IPO planned for September 2019. In the filing to go public, the company revealed more than $900M in losses over the course of 6 months with total revenues of $1.5B. Neumann reportedly cashed out of $700 million in stock ahead of the IPO. Not the best move to convince investors to buy the stock.

The IPO was delayed and many investigators looked into Neumann’s financial shenanigans.

In September 2019, WeWork’s IPO attempt failed. Softbank took control of the company and slashed the firm’s fair value by more than 80%. Softbank suggested that either the company wiped out the equivalent of 5 years worth of value, or they were greatly overvalued 5 years before. WeWork’s property, plant and equipment were estimated worth more than the company’s fair value at the time.

Financial and Behaviour Misconduct

WeWork’s IPO filing in the summer of 2019 was a major turning point for many investors. During this period, the company was obligated to disclose information that was still unknown by its biggest backers. Here are a few examples.

- Neumann privately bought property that he then leased to WeWork. And at the same time, Neumann borrowed money from WeWork at little to no interest. So the company was paying him rent while lending him money.

- The “sizeable chunk” of weed brought on a private jet across international borders as well as his general “unusual exuberance and excess” led Neumann to being pushed out of the company.

- The company made a list of acquisitions like the $13 million investment in a wave pool company that were not so relevant to WeWork’s core business. Not mentioning that WeWork is still burning through piles of cash.

- WeWork paid Neumann nearly $6 million to change its name to “The We Company,” a trademark that Neumann owned.

These allegations added to the company’s reported losses were the main reasons why WeWork collapsed in valuation.

Financial Risks

WeWork’s concept of “arbitrage” between long and short-term leases has its perks, but also contains much risk, especially when offices don’t rent.

These circumstances aren’t quite as rare as you may think. Based on personal observations in Paris, some WeWorks rent out the first few floors of the building but the upper floors remain empty (~400m2 office spaces per floor). Empty space per meter squared in prestigious parts of Paris can be very costly for the company, and reduce significantly their profit margin. For a company that generates revenue based on tight margins and the volume of customers, costs can have a great impact on earnings.

WeWork could also see a decrease in the number of memberships in the next economic downturn as SMBs and Freelancers are still their biggest customers.

The company admits in its IPO filing, “SMBs and Freelancers may be disproportionately affected by adverse economic conditions.”

Very asset intensive

WeWork’s costs of refurbishment are also a great issue for the company’s profitability. Before renting the offices, WeWork renews their offices by repainting the walls, building glass doors to separate the office spaces, and decorates the rooms with expensive furniture such as marble tables and suede couches.

As of June 2019, WeWork’s balance sheet shows $6.7 billion in property, plant and equipment and $15.1 billion of lease assets, for a total of $21.8 billion. Assuming 2019 whole-year revenues of roughly $4 billion, that is just a 0.2 sales/assets ratio.

In order to earn its cost of capital, it will have to generate very large profits/cash flow to offset its asset intensity.

Overall, WeWork’s costs of operating are significantly higher than their revenue. In 2019, Q1 and Q2 combined, WeWork lost $900 million, $3 billion in operating costs and had $20 billion in total net debt (Source : craft.co).

My Final Thoughts

From a customer point of view, WeWork is a very enjoyable co-working space with all you need to work efficiently : high speed internet, big tables with charging plugs, conference rooms, telephone booths, proximity to other companies, networking events, free beer (between 6–8pm) and so forth. WeWork has no doubt revolutionised the co-working experience.

From an investor’s standpoint, WeWork is suffering from major financial issues. The 3 biggest issues in my opinion are the company’s $100M/month burn rate, WeWork’s solvability and future funding, and the potential economic downturn due to Covid-19.

As Neumann once said, “If your business is the right business, then money will never be an issue”.